Missed EMIs, Recovery Calls & Sleepless Nights?

Facing EMI pressure, recovery calls, or financial stress? Loan Maaf helps you legally reduce loan burden and regain peace of mind.

Reduce Your Loan Burden Legally & Reliably

Our services

Simple, Transparent Loan Support Services

We clearly explain every step, cost, and option — so you stay in control.

We take over stressful recovery calls from banks and lenders so you can focus on your life without constant pressure and harassment.

We help prevent unwanted recovery visits and provide proper legal guidance to protect your rights and privacy.

We negotiate with banks and NBFCs on your behalf to help settle your loans legally and reduce your financial burden.

We assist you in properly closing your settled debts and obtaining no-dues/closure confirmation so you can move forward with peace of mind and financial freedom

We take over stressful recovery calls from banks and lenders so you can focus on your life without constant pressure and harassment.

We help prevent unwanted recovery visits and provide proper legal guidance to protect your rights and privacy.

We negotiate with banks and NBFCs on your behalf to help settle your loans legally and reduce your financial burden.

Years of experience

Practical & Flexible Loan Solutions That Fit Your Life

With 12+ years of experience, Loan Maaf understands real financial problems. We guide you with realistic, lawful, and stress-free solutions — not false promises.

- Confidential & Professional Support

- Experienced in Loan Settlement Cases

- Legal & Ethical Process

- Client-First Approach

- Pan-India Assistance

HONEST & FAIR SOLUTIONS

Relief-Focused Guidance That Saves You Money & Mental Stress

At Loan Maaf, our goal is to help borrowers legally reduce loan burden through structured settlement and negotiation guidance.

Instead of pushing unrealistic commitments, we help you understand what truly works in your case — whether it’s restructuring, settlement guidance, or negotiation support.

We follow a transparent pricing structure with no hidden fees, so you always know what you’re paying for and why.

Our strategies are based on real-world experience — not theoretical promises or shortcuts.

HOW IT WORKS

How Loan Settlement Works

There are 5 clear phases in our loan settlement process:

Share information about your unsecured debts (credit cards, personal loans etc) with our counsellors and check your eligibility

Sign up with us after signing a legal agreement that protects your interest and enables debt resolution

Start saving for loan resolution and let us handle your worries and harassment

After you have saved enough funds, discuss with your creditors to resolve your loans based on your payment capacity.

We will work hard to get you the best possible resolution so that you can become debt free!

Early Action Can Save You From Bigger Trouble

Ignoring loan stress increases pressure and legal risk. Timely guidance can protect your peace, credit, and future.

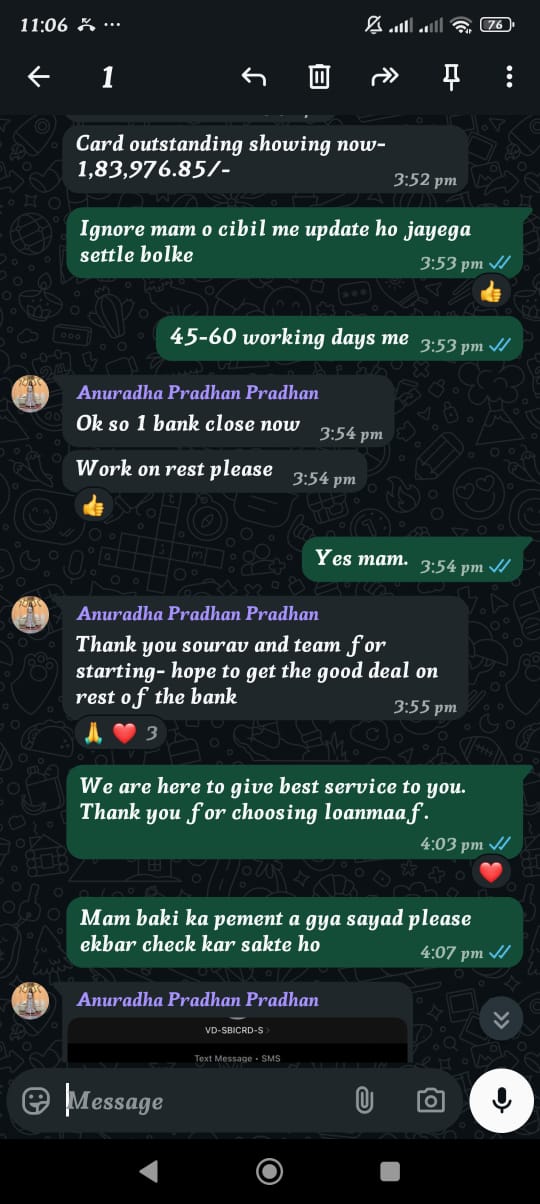

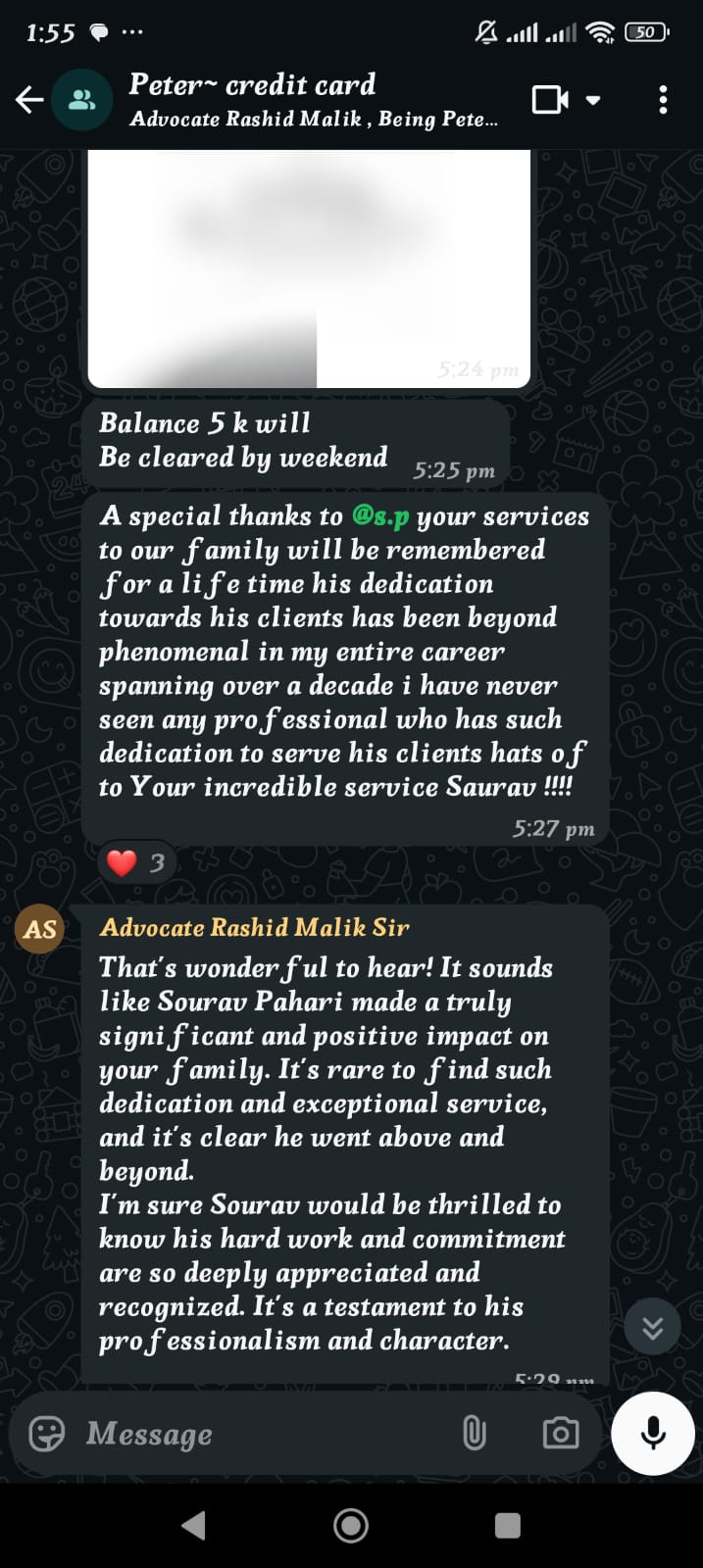

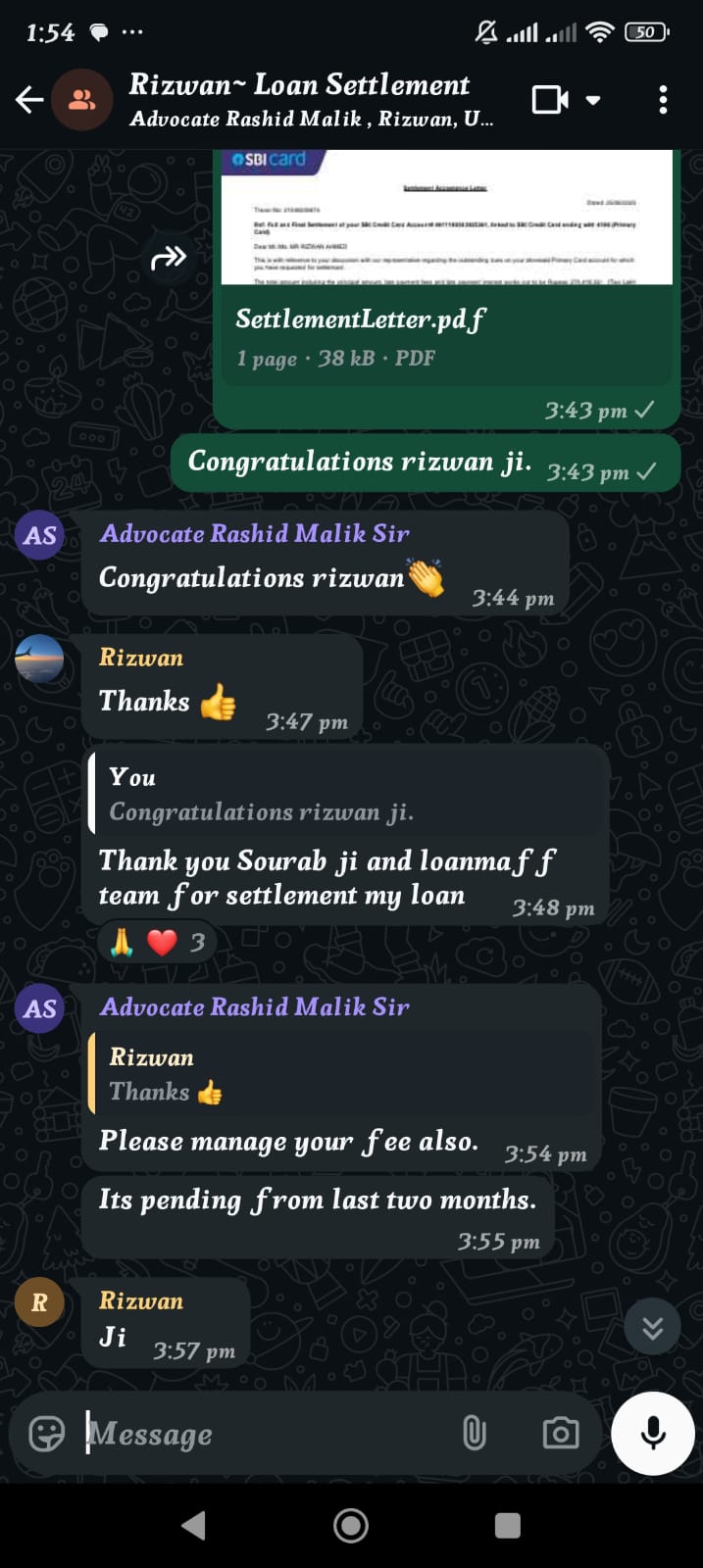

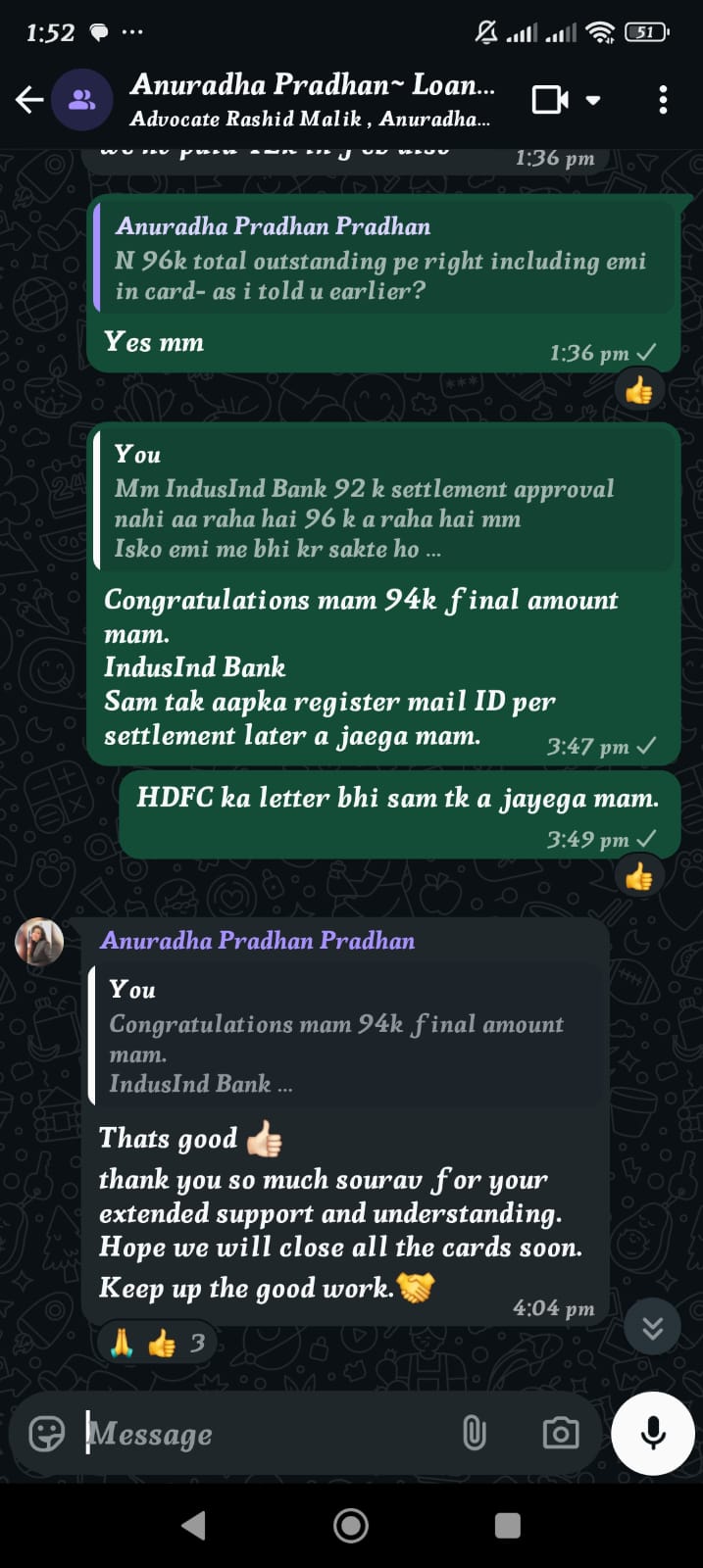

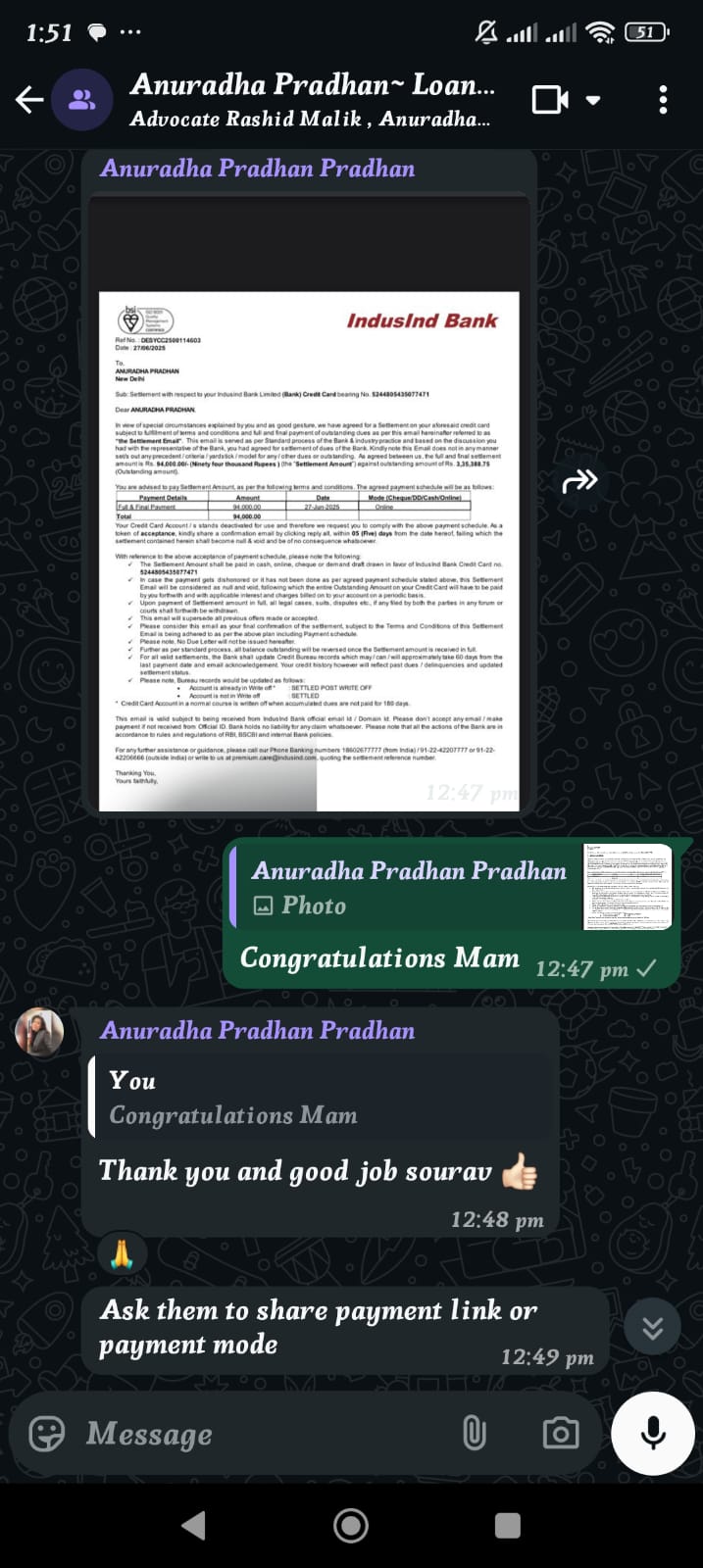

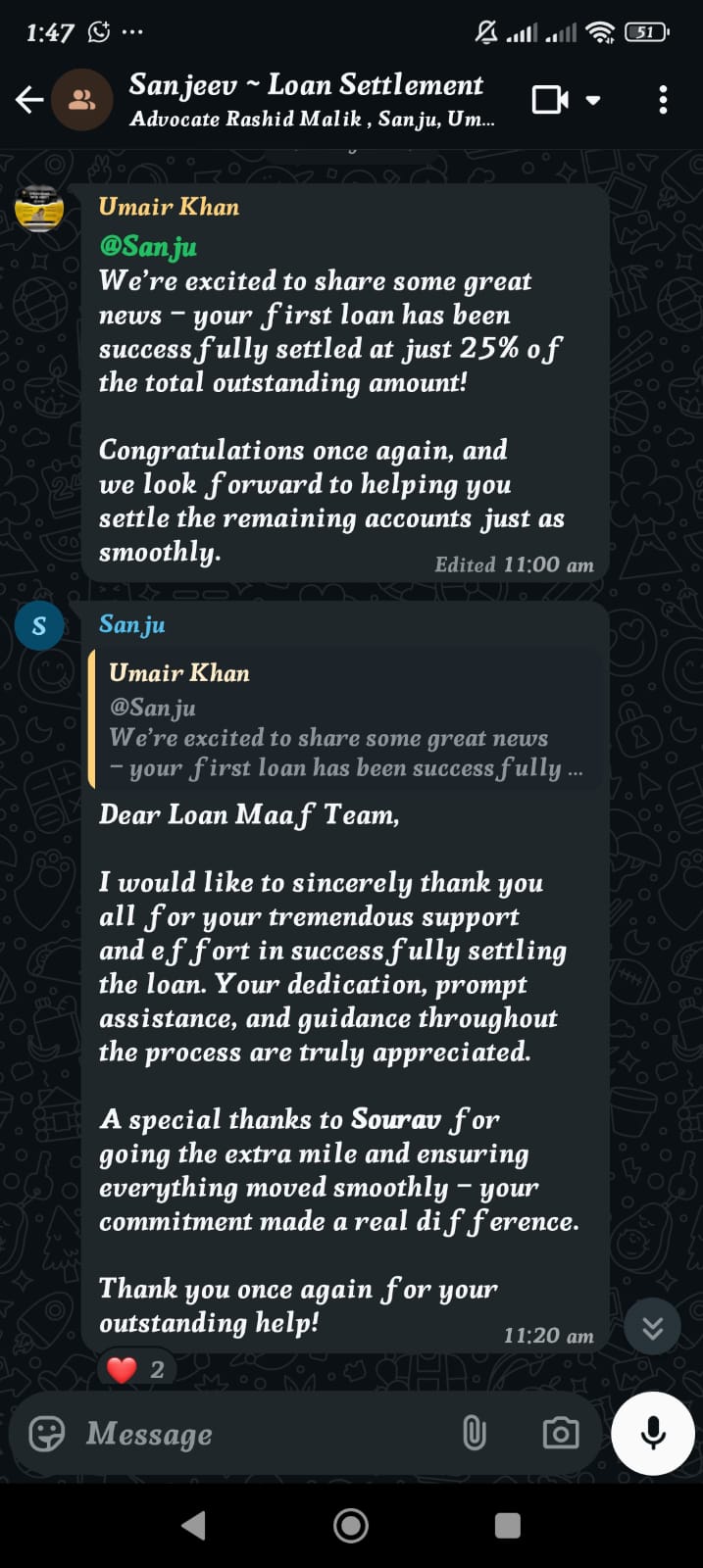

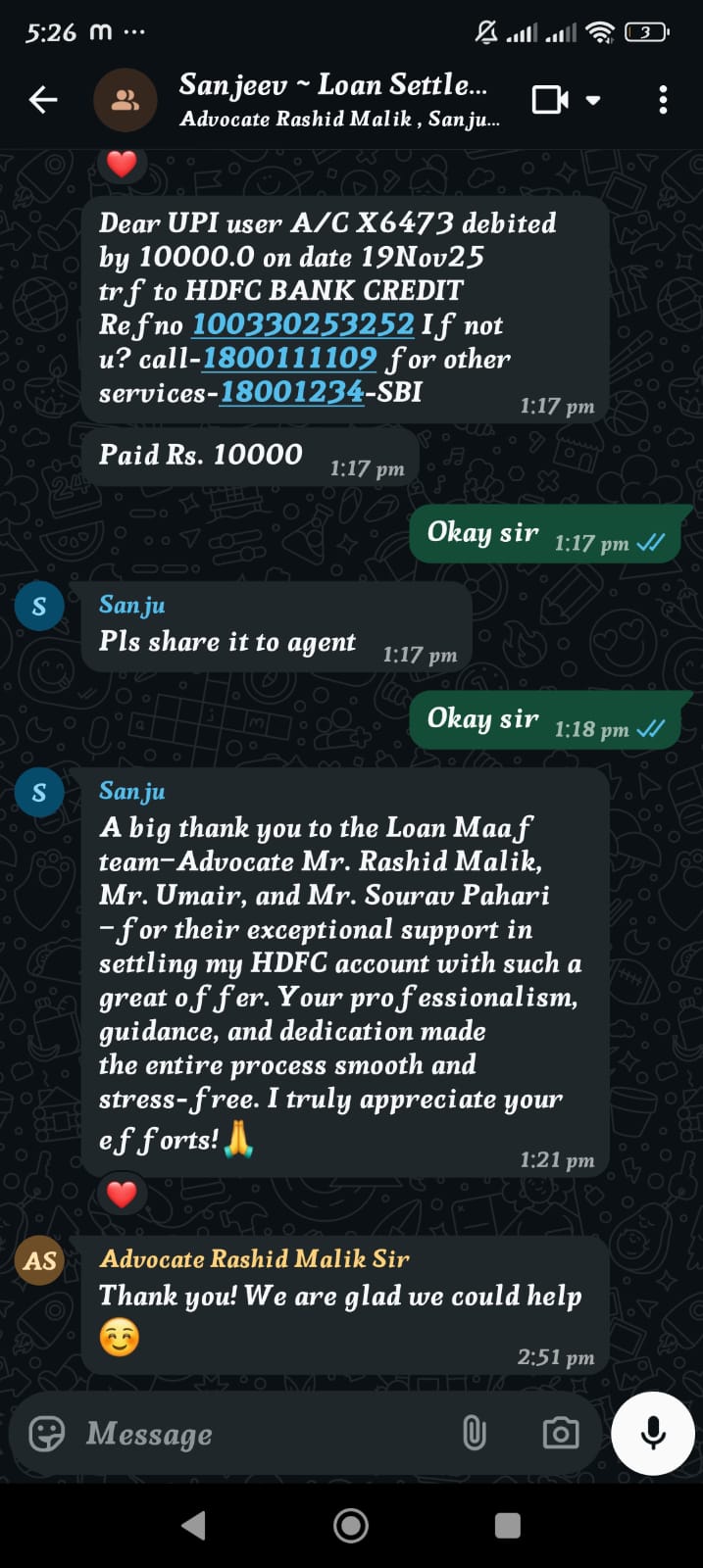

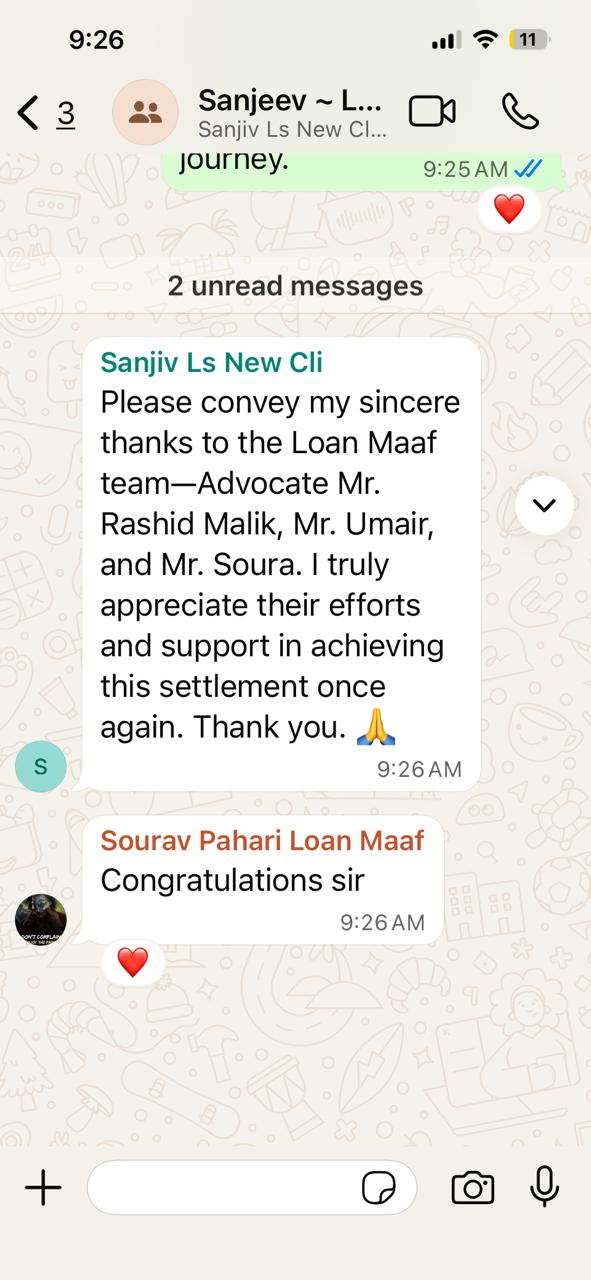

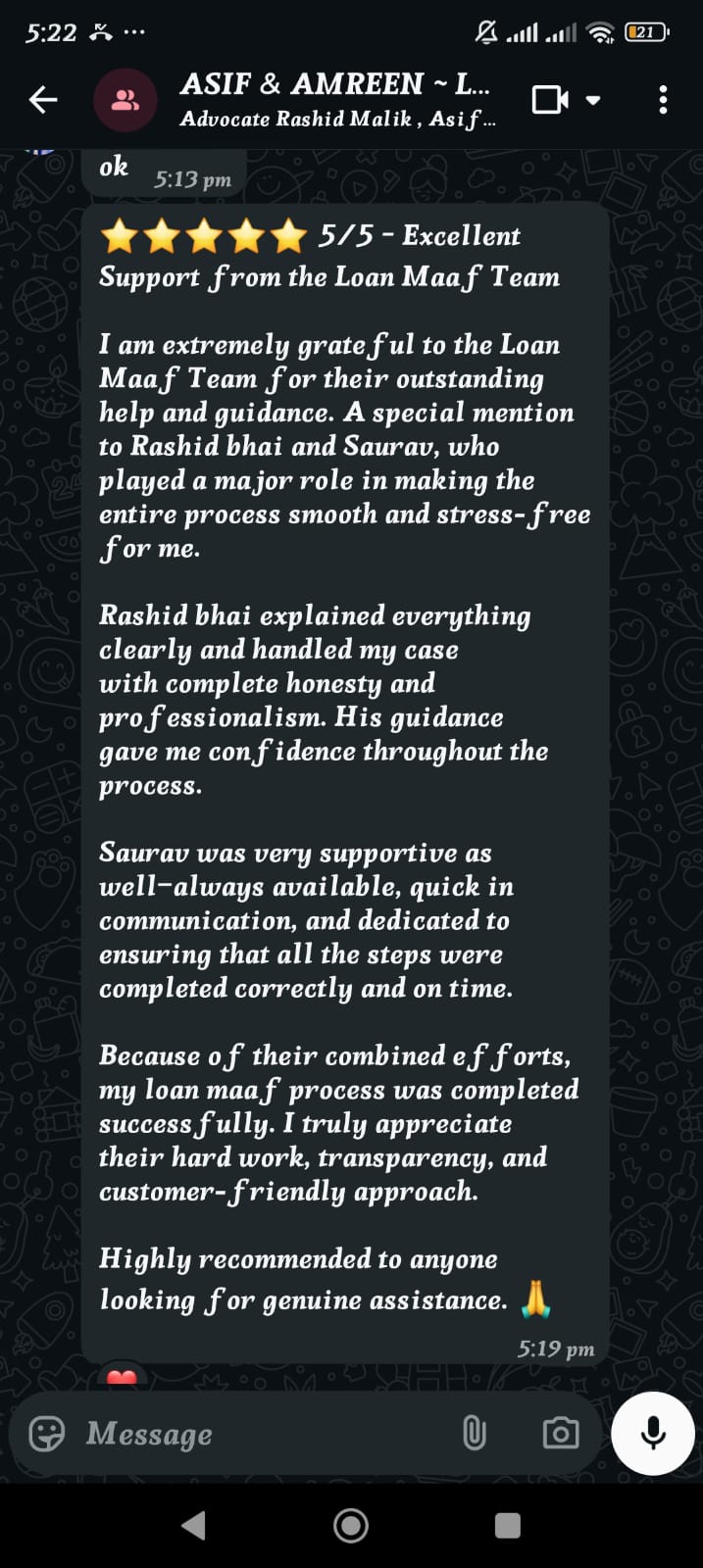

Our Client Reviews

Real feedback from real customers. See why homeowners trust us for reliable service, quality results, and outstanding customer care.

QUICK ASSISTANCE

Early Action Can Save You From Bigger Trouble

Ignoring loan stress increases pressure and legal risk. Timely guidance can protect your peace, credit, and future.

+91 9622289229

100% CONFIDENTIAL

Your Privacy & Financial Data Are Fully Protected

All discussions, documents, and personal information remain strictly confidential and secure with Loan Maaf.

Settle Your Loans with India's Best Loan Settlement Company

CONTACT LOAN MAAF

Don’t Let Loan Stress Control Your Life

Talk to our experts today and take the first step toward financial relief and peace of mind.

Frequently asked questions

We understand loan stress can be overwhelming. Here are honest, simple answers to the questions our clients ask us most before starting their settlement journey.

Loan settlement is the process of negotiating with creditors to pay off a debt based on your paying capacity. It is also known as debt settlement, debt relief, or debt resolution.

We can help you in resolving unsecured loans like personal loans, credit card debts, consumer loans, unsecured business loans etc. We cannot assist in collateral based loans like home loans, auto loans, gold loans and consumer durable loans.

It may vary from case to case but can take between 3 months to 1 year.

You should continue to pay your monthly EMIs to the lenders as far as possible. In case you anticipate that you may miss a payment, do contact the lender and take assistance from our team for possible solutions.

You creditors will continue to add interest and late fee into your account. However, at the time of settlement, the lenders may waive the interest or late fees at their discretion.

You may continue to get calls from the bank or recovery agents. However, do note that they are bound to follow certain code of conduct as laid down by RBI and Supreme Court of India. You can redirect the calls to our team and our legal team will handle the communication as per the laid down guidelines and laws of the country.

The creditor has the right to file a case for non-payment of dues but most creditors are willing to settle if there is a possibility. Our panel of lawyers can help you in handling these cases if the need arises.